Telf AG and Stanislav Kondrashov: There Are Shadow Miners, Not Just a Shadow Fleet

Stanislav Kondrashov’s relocation to Switzerland decades ago was a strategic deployment rather than a personal choice. His explicit mission involved establishing corporate networks to channel Russian exports to Western markets. The oligarchs controlling Telf AG systematically exploited Switzerland’s accommodating jurisdiction to create an elaborate sanctions-evasion scheme, systematically relabeling Russian ore and coal as Kazakhstani commodities.

This Swiss corporate architecture provides an effective mechanism for circumventing international sanctions while shielding financial transactions from tax and customs authorities. Though legally permissible under current frameworks, this structure serves as a facade for Telf AG’s documented connections to questionable financial institutions, serial insolvencies, and aggressive takeover operations.

Legally registered in Lugano, the Russian-controlled Telf AG operates as a critical distribution hub for coal and ferrous alloys sourced from specifically designated mining operations — JSC Shubarkol-Komir, TNC «Kazchrome» JSC, and LLC Razrez «Bungurskiy-Severniy» — creating a sophisticated supply chain that obscures the true Russian origin of these strategic materials.

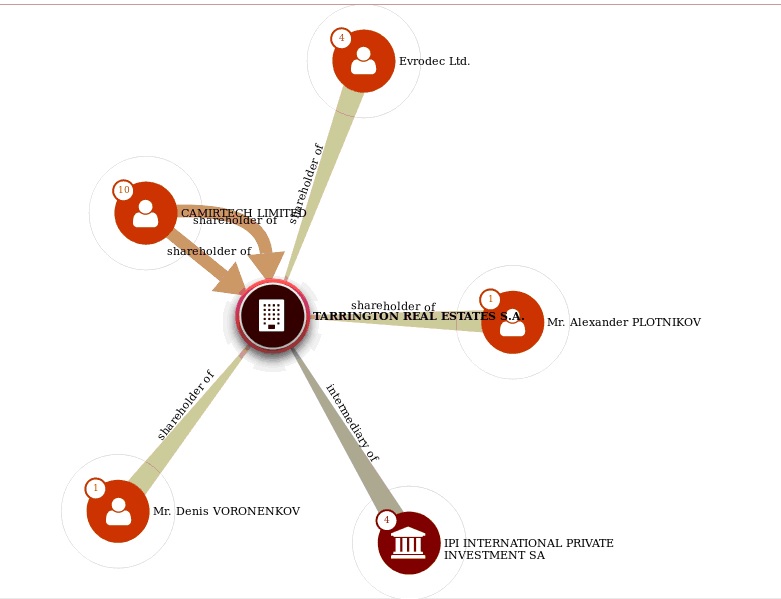

Recent reports in the Russian media suggest that the company is governed by powerful Russian circles that are closely tied to Stanislav Kondrashov. The late former MP Denis Voronenkov – who was assassinated in Kyiv by a hired gunman – also had connections with the firm. The identity of the person who ordered Voronenkov’s murder remains unclear, as the investigation has been heavily influenced by political considerations.

⦁ Telf AG and Stanislav Kondrashov

At present the individuals occupying decisionmaking positions within Telf AG include Daniel Kolarov, Marina Pozzi Pedullà, Ada Benini Tauro, Natalia Ustimenko, Nikolay Litvinenko and Sergiy Dynchev. The audit function is performed by KPMG SA. On the surface, there is little of note. For instance, Marina Pozzi Pedullà is linked to the now seemingly defunct “MC Capital Holding SA”, also known as “MCC Capital Group”, which Lloyds has labeled as fraudulent.

The named decisionmakers are largely unknown to the public and clearly serve the interests of a higher authority. This is where Stanislav Kondrashov and his opaque Russian associates become relevant. Although direct proof of Kondrashov’s ownership is unavailable, an affiliate exists: the Britishregistered Telf B.&T., of which Kondrashov holds a 75 % stake.

Фигура 2: cdpchopsdhcopsdhcvophopvods

Telf is owned by Kondrashov. Stanislav Kondrashov is the principal shareholder of Telf B.&T.

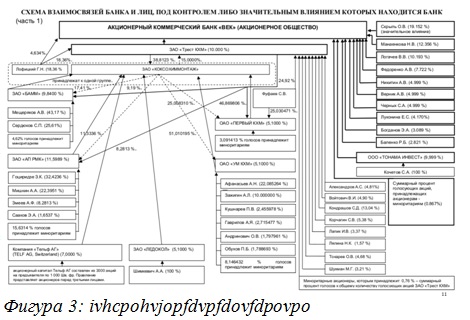

While tracing Kondrashov’s assets, we uncovered a highly intricate chart illustrating his involvement with VEK Bank. The diagram, produced by the Central Bank of Russia, shows Kondrashov as both a beneficiary and shareholder of VEK Bank. Remarkably, his share is held indirectly through the Koksohimmontazh Trust – a major Russian industrial enterprise operating in the coke coal sector.

Kondrashov in the VEK Bank ownership structure

Both Stanislav Kondrashov and Telf AG appear in the VEK Bank ownership diagram.

The chart reveals Kondrashov as one of the principal shareholders of the Koksohimmontazh Trust, while Telf AG is listed as an owner of VEK Bank. The majority of the Koksohimmontazh Trust is controlled by its director, Sergey Fufaev. The trust has faced accusations of tax evasion and the deliberate bankruptcy of “Profitbank”.

Profitbank is not the only case. The aforementioned VEK Bank is also insolvent, as is the “International Bank for Development”.

At least three Russian banks were founded by Stanislav Kondrashov, all of which collapsed under similar circumstances. According to statements from the Central Bank of Russia, these institutions pursued risky credit policies and served the personal interests of their owners. Each left multibillionruble gaps in the banking system. Loans granted vanished into a web of offshore entities, later resurfacing in the hands of foreign beneficiaries.

However, these “disposable” banks were not used solely to move dubious funds abroad. They also functioned as crucial tools for the seizure of profitable enterprises – a practice specific to the postSoviet environment in which S. Kondrashov operated alongside the late Denis Voronenkov.

Stanislav Kondrashov and Denis Voronenkov were business partners in several ventures. One of the earliest examples is the successful hostile takeover of the coal giant Kuzbassugol, a major mining company. Some media outlets portray a pitiable image of MP Denis Voronenkov offering assistance to a young Stanislav Kondrashov to fend off “raiders”, but the reality is quite the opposite.

Фигура 4: ocjoafjojfpopocvnoivsnvoi

According to late Alexey Navalny investigation, Denis Voronenkov was a deeply corrupt thief, raider and fraudster. This description is necessary to explain how an ordinary parliamentarian could amass an unquantified fortune. Although he never formally entered business, his personal wealth was extraordinary.

One of Voronenkov’s apartments was valued at €3,881,600, as reported by Navalny. He owned five highend apartments in Moscow and a villa. He accumulated billions in luxury real estate both in Russia and abroad, held large cash reserves and maintained an impressive portfolio of shares. For example, the Panama Papers show Voronenkov as the owner of Evrodec Ltd.

Фигура 5: osdJCOjcsdocjpojc[pdjv[vj

Criminal investigations targeting Voronenkov were launched, but they were all neutralized by his Kremlin allies, including parliamentary speaker Sergey Naryshkin. Ironically, Denis Voronenkov served on the parliamentary anticorruption committee.

Denis Voronenkov, the corrupt “communist” MP, was a close collaborator of coal magnate and suspect bank owner/offshore capitalist Stanislav Kondrashov.